Are you overworked due to the increasing demands of your business? Managing clients, practice management, and business development demand tremendous work and time. These challenges can hinder the growth of your business and potentially cause you to lose business to competitors. To streamline business demands and work towards increasing revenue in the current market, we propose five tips and tactics to grow business faster in 2022. These methods help you focus on core competencies and improve your overall business operations.

1. Assure Client Satisfaction

Make client satisfaction a priority. This can be a challenge, as managing clients and their requirements can represent an extensive amount of work. However, as a business owner, your responsibility is to ensure that your clients are satisfied and that they feel like you have delivered exceptional service. It is an excellent idea to help them identify their core issues and scale their operations. This sets the stage for repeat business and recurring revenue.

Often today, many accounting firms provide additional, complementary services to their clients to help increase revenue. To accomplish this, these firms often partner with other companies to deliver these services while “selling them” as their own. Additionally, it is a great way to expand your business, products, and services.

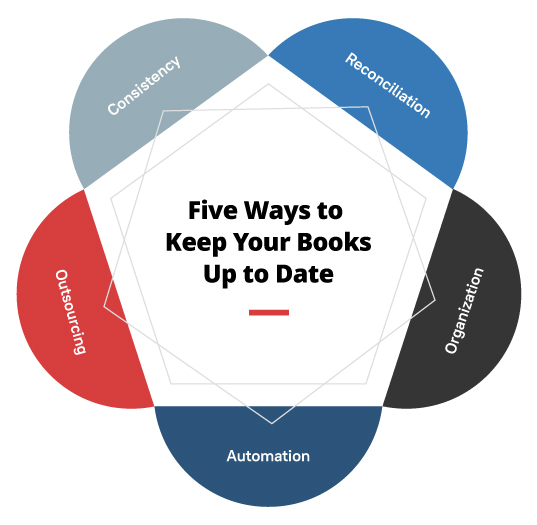

2. Accounting Automation Tools

Start adopting and investing in technology that helps improve process automation, data integration, and machine learning to automate data processing tasks, gain insights for better decision-making, and quickly accept new trends and strategies. Integrating advanced accounting and business management software can help you automate regular tasks and reduce workload. Moreover, you can leverage your employees to do more comprehensive and strategic tasks. Many growing companies pursue these tactics to gain market share and leadership.

3. Strengthen Engagement Models

Listen to your client’s needs and concerns when engaging with them. Better collaboration allows teams to communicate efficiently and complete projects faster. Sometimes a single point of contact is more critical for a client to streamline communication, whereas at other times, interacting with the team performing the function or operation is a better strategy. If possible, remain flexible in how you engage with clients. Adopting seamless collaboration methods can allow businesses to perform well and allocate resources effectively.

4. Improve Existing Process

If you are looking for better ways to improve productivity and reduce workload in the organization, then focus on monitoring the existing business process. It will allow you to change weak strategies and improve operations and functions. Such steps can change the turnaround time of the projects, allocate resources more efficiently, and help distinguish business performance. There is always room for improvement, even if it is simply closing some process gaps. The sooner you start identifying these gaps in your current process, the sooner you can grow your business.

5. Say Yes to Outsourcing

Outsourcing provides expertise that can help you to scale your business operations. It is the best way to hire on-demand, experienced, dedicated resources to work on challenging tasks. Outsourcing firms have access to a talent pool that allows firms to obtain immediate solutions at competitive rates. Moreover, their pay-per-use model simultaneously helps manage costs.

Outsourcing Benefits

- It helps you focus on core competencies

- Expands your team

- Reduces workload

- Assistance with Project management

- Supports timely delivery of projects

- Benefits business thanks to detailed analysis and reports

Core Accounting offers a strategic partnership to clients to ensure steady business growth and confidence in delivering high-quality and accurate work.